Comparing The Top Stock Trading Platforms In 2025

As we look ahead to 2025, the stock trading landscape continues to evolve rapidly. In an age where technology is reshaping financial markets, stock trading platforms have had to adapt and improve to meet the growing demands of individual investors. The market is now filled with various platforms that cater to different types of traders, from beginners to seasoned professionals. These platforms are no longer just about buying and selling stocks; they offer a comprehensive range of features, from sophisticated charting tools to educational resources. In this article, we'll compare some of the top stock trading platforms likely to dominate the market in 2025, focusing on their key features, user experience, and what makes them stand out.

E*TRADE: A Comprehensive Platform For All Types Of Traders

ETRADE has long been recognized as one of the top choices for investors looking for an all-in-one platform that offers a wide range of features. As we move into 2025, ETRADE continues to impress with its robust selection of tools, educational resources, and user-friendly interface.

One of ETRADE's standout features is its extensive research and analysis tools. It provides access to market reports, real-time data, and in-depth stock analysis from top financial sources. Whether you are a beginner or an experienced trader, the platform's tools cater to different skill levels. ETRADE also offers commission-free trading on stocks and ETFs, making it an attractive option for cost-conscious traders. Additionally, its mobile app provides a seamless trading experience, allowing users to manage their portfolios.

Charles Schwab: A Trusted Name With Cutting-Edge Technology

Charles Schwab remains a trusted and reliable platform for investors of all levels. As of 2025, it has made significant strides in combining traditional investment practices with innovative technology. Charles Schwab's stock trading platform offers a robust suite of tools, including in-depth market research, real-time data feeds, and access to comprehensive investment resources.

What sets Charles Schwab apart is its commitment to zero-fee trading on stocks and ETFs, a game-changer for many traders. In addition to its zero-fee policy, Schwab offers a wide range of investment products, from stocks and bonds to mutual funds and options. For beginners, Schwab's educational resources are second to none, providing detailed courses and articles that help users understand the basics of investing.

For more experienced traders, Charles Schwab offers advanced charting tools, real-time data analysis, and access to professional-grade research. Schwab also introduced a new feature called "Schwab Intelligent Portfolios," which leverages AI to help users build diversified portfolios based on risk tolerance and financial goals. In 2025, Charles Schwab will continue improving its AI-powered tools, making it easier for investors to make informed decisions in real-time.

Robinhood: Simplicity And Innovation For The Modern Trader

Robinhood has made a name by offering commission-free trading and a user-friendly interface. In 2025, it is expected to remain a top choice for those prioritizing ease of use and low-cost trading. With its sleek, minimalist design, Robinhood makes it incredibly easy for new traders to get started with the stock market.

Robinhood's key strength lies in its simplicity. It offers a straightforward approach to buying and selling stocks, options, and cryptocurrencies, making it an excellent choice for beginners. The platform's commission-free model also makes it attractive to those who want to avoid the fees associated with traditional brokerage firms.

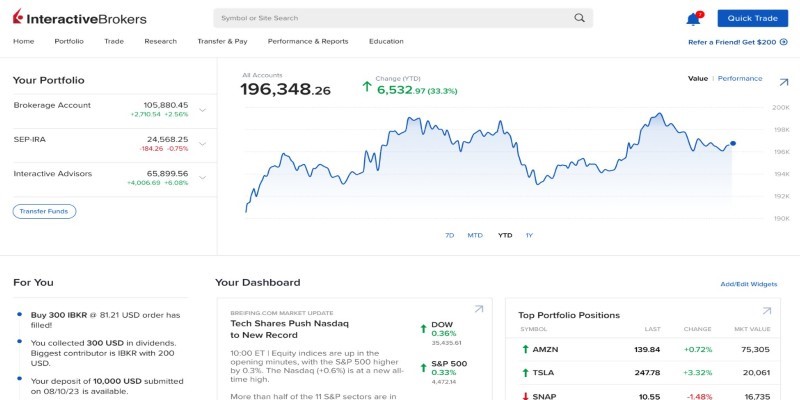

Interactive Brokers: The Go-To Platform For Active And Professional Traders

Interactive Brokers (IBKR) is a powerhouse in online stock trading. It has long been the go-to platform for professional traders due to its low-cost structure, advanced trading tools, and access to a wide range of markets. By 2025, Interactive Brokers is expected to maintain its position as one of the most comprehensive platforms available, offering access to global markets, including stocks, options, futures, and forex.

IBKR's platform is known for its robust features, including advanced charting tools, automated trading capabilities, and risk management tools. One of Interactive Brokers' most significant advantages is its ability to provide access to international markets, which is ideal for traders looking to diversify their portfolios with global assets.

The platform offers a tiered pricing structure, meaning users can choose the pricing model that best suits their trading style. Active traders who place many trades benefit from the lowest commissions, while casual investors can opt for the fixed-rate pricing model. In 2025, IBKR is expected to continue enhancing its platform with AI-powered tools that improve trading efficiency and risk management, making it a top choice for sophisticated traders.

TD Ameritrade: A Leader In Research And Education

TD Ameritrade is widely recognized for its exceptional research and educational resources. By 2025, it is expected to remain one of the most comprehensive platforms available, catering to beginner and professional traders. TD Ameritrade's thinkorswim platform is one of the most powerful trading platforms on the market, offering advanced charting, technical analysis tools, and real-time data.

One of TD Ameritrade's standout features is its research capabilities. The platform provides access to reports from top analysts, real-time news, and various market research tools. For beginner traders, TD Ameritrade offers a wealth of educational materials, including webinars, tutorials, and a comprehensive learning centre. These resources are tailored to different experience levels, ensuring traders have the support to make informed decisions.

Conclusion

The stock trading platforms of 2025 will continue to innovate, offering more advanced tools, lower fees, and enhanced educational resources to cater to a diverse range of investors. While platforms like E*TRADE, Charles Schwab, and TD Ameritrade remain strong contenders with their comprehensive offerings, newer platforms like Robinhood, Webull, and Interactive Brokers quickly gain ground due to their user-friendly interfaces, commission-free trading and advanced features.

When choosing the right stock trading platform, investors should consider their experience level, trading preferences, and specific needs. Whether you're a beginner looking for simple tools or an active trader seeking advanced charting and risk management features, there's a platform out there that can help you achieve your financial goals. As technology evolves, we can expect these platforms to integrate further artificial intelligence, machine learning, and other advanced technologies to enhance trading strategies and improve the overall trading experience.